Youth discount, Lifetime Health Cover (LHC) loading, Medicare Levy Surcharge (MLS) and hospital cover

Youth discount, Lifetime Health Cover (LHC) loading, Medicare Levy Surcharge (MLS) and hospital cover

We've got you're back with this rundown of discounts, loadings, surcharges and other things you need to know about the cost of your private hospital cover.

Youth discount

Youth discount

If you’re aged 18 – 29 and a Principal member (that’s the first person listed on your membership, the person responsible for the payment of premiums and you have full authority to make changes to your membership), you can get a discount on your hospital cover. So it’s a good idea to set up private health insurance while you’re young. Learn more about the youth discount.

Lifetime Health Cover (LHC) loading

Lifetime Health Cover (LHC) loading

Health insurance acronym #234, the LHC loading is a government initiative that’s designed to encourage people to take out and maintain private hospital insurance once they turn 31.

If you don’t have hospital cover by 1 July following your 31st birthday and you choose to take it out later in life, a loading of 2% will be applied to your hospital cover premium (up to a maximum of 70%) for each year you’re over the age of 30 without hospital cover. This is called the LHC loading.

But, if you take out hospital or hospital and extras cover on or before 1 July following your 31st birthday, you don’t need to worry about it as long as you maintain your hospital cover. Find out more about LHC.

Medicare Levy Surcharge (MLS)

Medicare Levy Surcharge (MLS)

If you earn more than the specified income threshold, having private hospital cover could possibly mean that you don’t have to pay the Medicare levy surcharge (MLS).

The MLS is a levy you may need to pay if you don't have an appropriate level of private hospital cover for you and all your dependants and earn over $90,000 (for singles) and $180,000 (couples, families and single parents). (The income threshold for families goes up by $1,500 for each child born after the first child.) Find out more about the Medicare Levy Surcharge.

Your budget, your choice

Your budget, your choice

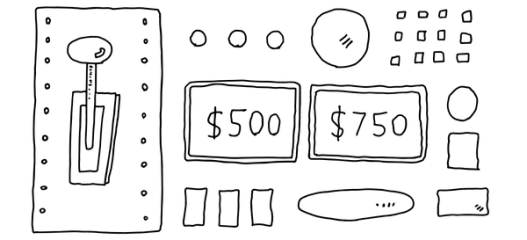

Everyone deserves the peace of mind that comes with having private health insurance. So we have different options when it comes to price, payment and use of your cover, to suit all budgets.

Your choice of cover

Your choice of cover

Extras, hospital or both. We have options, so you choose what suits you and your budget the best.

Payment frequency

Payment frequency

Choose to pay for your health insurance weekly, fortnightly, monthly or annually. Whatever suits your needs and your budget.

Excess

Excess

Excess is an up-front cost you pay when you’re admitted to a private hospital, and you want to use your hospital cover. We have excess options. You can opt for a higher excess so your regular cover payments will be lower.

Claim your way

Claim your way

You can claim for most of your included extras services over the counter at your provider, online or via the app. It’s up to you. And all online claims are assessed within 5 business days. Easy.

How much will it cost to go to hospital?

How much will it cost to go to hospital?

If you have private health insurance hospital cover, you can go to a private hospital as a private patient, and use your cover to help with the bill for any services or treatments included in your cover.

You’ll probably pay an excess

You’ll probably pay an excess

This is a flat, up-front cost you pay when you’re admitted to a private hospital, and you want to use your cover. If you opt for a higher excess your monthly hospital cover fees will be lower.

You might pay out-of-pocket costs

You might pay out-of-pocket costs

Out-of-pocket costs are all the bills involved in your treatment or service, minus any reimbursements from either us or Medicare.

The amount we can pay depends on your cover and your waiting periods. These are all important things to check when you’re looking at different cover options.

Common questions

Find extras and hospital cover that suits your needs

Find extras and hospital cover that suits your needs

Want both? We’ve got a range of extras and hospital cover options.